Getting Started

How fatBERA Works

- Users deposit BERA into the fatBERA protocol

- They receive an equivalent amount of fatBERA tokens (1:1 ratio)

- The deposited BERA is automatically withdrawn and staked to validators in the fatBERA consortium

- These validators earn BGT-based rewards through block validation

- Rewards are redeemed for BERA, converted into wBERA, and distributed to fatBERA holders as yield.

Yield Calculation

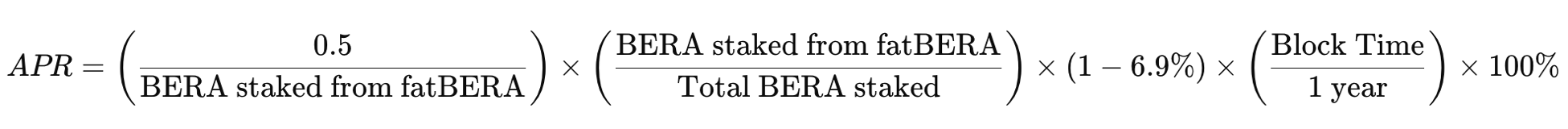

For each proposed block, validators receive 0.5 BGT as base rewards. These rewards are distributed proportionally based on the amount of BERA staked, with fatBERA charging a 6.9% fee on the rewards.

What is the APR (Expected Returns)

The current APR is displayed in the fatBERA web application. [View current rates]

Simply put, for each proposed block, the APR is calculated as:

It's important to understand that staking rewards are proportional to the amount staked.

A validator with 1M BERA staked earns exactly 1/10 the rewards of a validator with 10M BERA, resulting in identical yields per BERA. This proportionality means that fatBERA can provide competitive yields regardless of total stake size. 🚀 NOTE:

In theory, all LSTs (Liquidity Staking Tokens) should have the same base APR, as they are derived from the same validator rewards. The only difference between them comes from the service fees charged by each protocol.

For fatBERA, the APR formula simplifies to:

Validator APR×(1−6.9%)\text{Validator APR} \times (1 - 6.9\%)Validator APR×(1−6.9%)